La Caisse posted a mid-year 2025 return of 4.6% over six months and 7.7% over five years

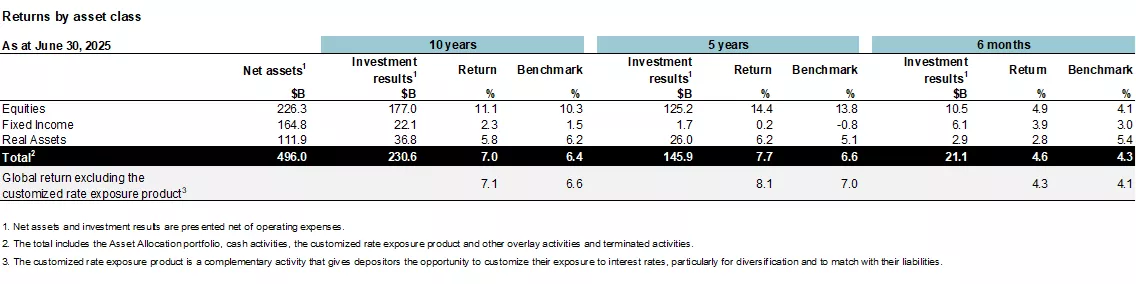

La Caisse today presented an update of its results as at June 30, 2025. Over six months, the weighted average return on its depositors’ funds was 4.6%, above its benchmark portfolio’s 4.3%. Over five years, the average annualized return was 7.7%, also outpacing the benchmark portfolio’s 6.6%. Over ten years, the average annualized return was 7.0%, also higher than its benchmark portfolio, which stood at 6.4%. As at June 30, 2025, La Caisse’s net assets were $496 billion, up $23 billion over six months.

“In the first half of the year, tariff issues related to U.S. policy were a major concern. Financial markets were highly volatile, with a correction in April followed by a robust rebound. Despite this overall performance, we must remain vigilant as we have yet to see the full effects of the U.S. administration’s measures,” said Charles Emond, President and Chief Executive Officer of La Caisse. “Against significant rate increases, stock market concentration and challenges in real estate over the past five years, our portfolio held strong and outperformed its benchmark portfolio. Our depositors’ plans, and therefore Quebecers’ pensions, are in excellent financial health.”

Return highlights

Equities

Equity Markets: Performance powered by Europe, Canada and emerging markets

In the first half of the year, global stock markets responded to the back-and-forth on tariffs with volatility, yet recorded gains. The MSCI ACWI Index, which includes both developed and emerging markets, posted a 4.4% return, hampered by the U.S. market, which suffered from uncertainty around the country’s economic policy. Indexes from several major regions, including the eurozone, Canada and emerging markets, delivered excellent performance. In this context, the Equity Markets portfolio recorded a 6.0% return, outperforming its benchmark portfolio’s 5.5% return. This result was due to all management mandates, with a significant contribution from Canadian and emerging market stocks, as well as timely risk-taking during the slide in early April.

Over five years, the annualized return was 13.3%, compared with 12.9% for the index. Drivers of this performance include the increase in exposure to major technology stocks and the contribution of Canadian portfolio companies over the period.

Private Equity: Portfolio companies continue to grow despite the market slowdown

Over six months, the portfolio turned in a 3.4% return, above its benchmark index, which posted a 2.0% return. The performance is explained by growth in the profitability of portfolio companies, both in Québec and internationally, but that was more moderate in a slowing environment. During the six-month period, the teams pursued their disposition strategy and completed just over $8 billion in materializations, while making new investments of $4 billion.

Over five years, the portfolio’s annualized return was 16.7%, compared with 15.4% for the benchmark index. Exposure to the technology, finance and industrial sectors was particularly beneficial over the period.

Fixed Income: Strong current yield due to high rate environment and credit Premiums

The first half of the year was characterized by escalating trade tensions and the risk of economic recession in the United States, as well as U.S. yields diverging from the rest of the world. In this context, the Fixed Income asset class generated a 3.9% six-month return, above its benchmark index’s 3.0%. The performance is due to a strong current yield of 2.8% and positive execution in government debt, corporate credit and capital solutions activities.

Over five years, the asset class posted an annualized return of 0.2%, still largely affected by 2022’s major market correction, compared to the index’s -0.8%. The quality of all credit activities explains the difference with the index.

Real Assets

Infrastructure: Constant return in an unstable geopolitical context

Over six months, the Infrastructure portfolio continued to be a pillar of stability for the overall portfolio. The return was 4.5%, buoyed primarily by transportation assets. Its benchmark index was 8.1%, boosted by the public stocks that compose it, which continue to be stimulated by the energy demand driven by artificial intelligence. In an environment that remains competitive due to the asset class’s particularly attractive profile, the teams were proactive. They completed nearly $4 billion of acquisitions, primarily abroad, in sectors such as telecommunications, data centres and power transmission. They also made targeted strategic sales to materialize gains and ensure portfolio turnover.

Over five years, the annualized return was 11.2%, compared with 9.0% for the index. The portfolio once again benefited from sound asset diversification and its favourable positioning in promising sectors, including renewable and transition energy, ports, highways and telecommunications.

Real Estate: Overall stabilization of the portfolio

In the first half of the year, the portfolio earned a 0.1% return, compared with the 1.2% return of its benchmark. The vast majority of sectors that make up the portfolio saw their values stabilize during the six‑month period. Shopping centres and offices posted good current yields after the pandemic shock. However, performance was limited by the impact of the higher-rate environment.

Over five years, the annualized return on the portfolio stands at 0.3%, in line with its index at 0.4%, reflecting the cyclical and structural challenges affecting the entire industry in recent years. The difference with the index is mainly due to the portfolio’s longstanding concentration in the U.S. office sector, which experienced difficulties over the period. It should be noted that the sectoral repositioning of the real estate portfolio toward sectors of the future, such as logistics, since 2020 was favourable over five years.

Impact of currencies on returns

In the first half of the year, the portfolio’s exposure to foreign currencies adversely impacted overall performance, mainly due to the sharp depreciation of the U.S. dollar. The partial hedging of this currency implemented by the teams, however, offered significant protection, offsetting nearly half of the negative impact. Over five years, foreign currency exposure contributed positively to overall performance, mainly due to the strength of the U.S. dollar over the period and the portfolio’s large exposure to it.

Québec: Support for local companies and structuring projects as the global economy redefines itself

The beginning of the year helped consolidate the positions of some Québec leaders in strategic industries, in addition to continuing to advance structuring projects. Highlights included:

Support to grow companies

- Innergex: Announcement of the acquisition of this renewable energy leader, bringing the enterprise value to $10 billion

- Norda Stelo: $28 million for an equity stake in this impact engineering leader, following two years as a lender, thereby reinforcing our partnership focused on sustainable innovation

- Germain Hotels: Leading a financing round for a total of $160 million to accelerate its expansion, and support for the company’s succession

- Synex Business Performance: Equity stake as a minority shareholder and support in the form of debt for this growing company in the Canadian insurance brokerage sector

Structuring projects

- REM: Migration of all operations to Brossard and start of the test period on two new branches (Deux-Montagnes and Anse-à-l’Orme) before the dry run stage at the end of the summer

- Québec-Toronto high-speed train: The Government of Canada selected the Cadence team, led by CDPQ Infra, as a private partner of Alto, the federal Crown corporation responsible for carrying out this major project for Canadian mobility

- TramCité: Announcement of consortia qualified for two major contracts as part of requests for expressions of interest led by CDPQ Infra; ultimately, this new 19-km modern tramway network will become the backbone of mobility in the Québec City region

Financial reporting

Cost management remains a priority for the organization. As such, the integration of the real estate subsidiaries, Ivanhoé Cambridge and Otéra Capital, into La Caisse, continued to benefit from the full potential of a simplified organization and to generate efficiency gains. Note that this integration, which began last year, will conclude in 2026. The synergies achieved already represent annual savings beyond the initial target of $100 million. Information on internal and external investment management costs as at December 31 will be presented in the annual disclosure.

The credit rating agencies reaffirmed La Caisse’s investment-grade ratings with a stable outlook, namely AAA (DBRS), AAA (S&P), Aaa (Moody’s) and AAA (Fitch Ratings).

ABOUT LA CAISSE

At La Caisse, formerly CDPQ, we have invested for 60 years with a dual mandate: generate optimal long-term returns for our 48 depositors, who represent over 6 million Quebecers, and contribute to Québec’s economic development.

As a global investment group, we are active in the major financial markets, private equity, infrastructure, real estate and private debt. As at June 30, 2025, La Caisse’s net assets totalled CAD 496 billion. For more information, visit lacaisse.com or consult our LinkedIn or Instagram pages.

La Caisse is a registered trademark of Caisse de dépôt et placement du Québec that is protected in Canada and other jurisdictions and licensed for use by its subsidiaries.

- 30 -